Guest Blog: Bengaluru Pips Pune In Office Market Activity In H1 FY2023

While Bengaluru and Pune remain the top commercial office destinations for IT-ITeS and coworking occupiers, Bengaluru has overtaken Pune in overall office space activity. ANAROCK’s India Office Market Update H1 FY23 indicates that with approx. 6.1 Mn sq. ft. of new office completions and approx. 6.08 Mn sq. ft. office absorption in H1 FY23, Bengaluru was far ahead of Pune in office activity. During the period, Pune saw a mere 0.85 Mn sq. ft. of new office completions and approx. 1.35 Mn sq. ft. of office space absorption in H1 FY23.

“However, Pune is ahead of its IT counterpart as far as office vacancy levels are concerned,” said Prashant Thakur, Sr. Director – Research, ANAROCK Group. “At 7.8%, Pune’s office vacancy rate is the lowest amongst all top 7 cities, including Bengaluru – which had an office vacancy of 10.9% in H1 FY23. Both cities recorded similar yearly growth of 6% in average monthly office rentals.”

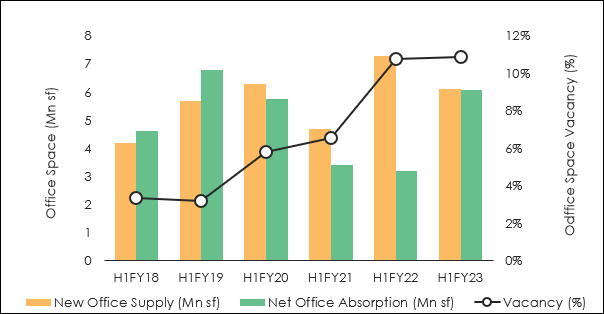

Both Pune and Bengaluru have seen the IT-ITeS sectors dominating office space demand over the last decade. However, Bengaluru has stood its ground despite past office demand slowdowns, including during the COVID-19 pandemic. It remains the country’s most active office market with approx. 6.08 mn sq. ft. net absorption in H1 FY23 – the highest recorded in the city in the last six years.

“Going forward, to the backdrop of a possible recession in the US in early 2023, it will be interesting to see how far these two cities’ office markets will be impacted,” says Thakur. “There is considerable uncertainty in many global economies, including Europe and the US, as they battle high inflation.”

Many multinationals and businesses have become cautious about expansion in such an environment. Many global tech giants have already started layoffs to curtail costs and weather-proof their balance sheets. Currently, the Indian economy is in a far stronger position than many of its western counterparts.

That said, India is not entirely decoupled from global markets, which provide it with a sizeable chunk of IT/ITeS business. Many corporate leasing decisions have already veered into the slow lane as they monitor global markets. This caution is likely to continue till early 2023.

Key Office Highlights

Bengaluru

- Approx. 6.1 Mn sq. ft. of new office supply was infused in the city in H1FY23 – at 26%, the 2nd highest share after Hyderabad among the top 7 markets. Y-o-Y, Bengaluru’s new office supply witnessed a 16% dip. Driven by healthy fresh corporate leases, Bengaluru saw net office absorption surge to 6.08 Mn sq. ft in H1FY23, surpassing the absorption recorded in the corresponding period in FY22 by 90%

- Avg. monthly office rentals in the city during H1FY23 stood at INR 84 per sq. ft. and continue to harden in the key micro-markets due to rising office space demand. The city’s average office rentals increased by 6% over the corresponding period in the previous year. City-wide vacancy levels remained almost stable at 10.9% in H1FY23, a marginal change of 0.1% over H1FY22

- With 35% of the leasing market share, the IT-ITeS sector led office market occupancy in the first half of FY23, followed by the BFSI and coworking at 30% and 18%, respectively

Bengaluru: Office Demand-supply Dynamics

Pune

- Approx. 0.85 Mn SF of new office supply entered the Pune market in H1FY23, declining by 32% over H1FY22. The city contributed the smallest share (4%) to India’s new office supply. On the net office absorption front, Pune saw net office absorption of 1.35 mn sq.ft.– the highest in the past six years. Absorption rose by 4% Y-o-Y in H1FY23 due to strong occupier demand

- Avg. monthly office rentals in H1FY23 increased by 6% to INR 74 per sq. ft. The city’s vacancy rate was pushed up by 3.3% – from 4.5% in H1 FY22 to 7.8% in H1 FY23.

- The top three largest office space occupiers in H1FY23 were IT-ITeS, coworking spaces, and Manufacturing / Industrial, with leasing transaction shares of 40%, 31%, and 18%, respectively

About the author- Prashant Thakur, Sr. Director – Research, ANAROCK Group