Guest Blog: Homebuying Trends-Service Class Dominates, Larger Homes Still In Highest Demand

Sales data at ANAROCK confirms that homebuyer preferences continue to evolve rapidly. Higher incomes and increasing awareness of global lifestyle and living standards are causing aspirations to transcend mere need. While the COVID-19 pandemic has rebooted the desire for ‘hard assets’ like housing, certain housing types are selling better than others. The fact that buyers are spoiled for choice allows them to pick and choose.

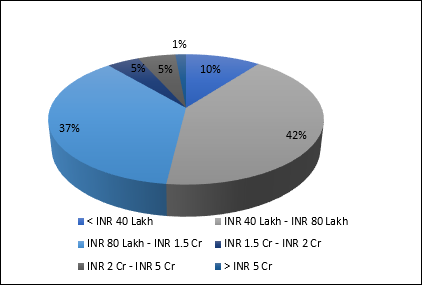

Certain trends become obvious when superimposing ANAROCK’s most recent sales figures on transaction data from the larger market. Buyers’ focus has clearly shifted from affordable housing (homes priced under INR 40 Lakh) to mid-end (INR 40 – 80 Lakh) and high-end homes (INR 80 Lakh to INR 1.5 Cr). This is very evident from analyzing buyer behavior in the top seven cities in the last fiscal year FY21-22 – nearly 80% of demand is for mid-end and high-end homes, with the affordable housing segment accounting for a mere 10% of the demand.

Rahul Phondge, Chief Business Officer, ANAROCK Group, said, “Chennai and Pune showcased the highest demand in the mid-end segment and accounted for nearly 60% and 59% of the total demand in these cities. Bengaluru recorded almost 56% of demand geared towards the high-end segment. Of the city’s overall housing sales, Hyderabad displayed the highest demand for luxury (17%) and ultra-luxury (8%) segment homes priced above INR 2.5 Cr. While average prices in Hyderabad are much lower than in the Mumbai Metropolitan Region (MMR), property sizes in these segments are significantly larger than in MMR.”

Across the major cities, the 2 and 3 BHK typologies yielded the maximum demand, accounting for 64% of the overall demand. 2 BHK units are most popular in Chennai, where nearly 67% of sales during the fiscal year were for this configuration. Bengaluru sold the most 3 BHK units, which accounted for 49% of overall sales during the year, closely followed by Hyderabad with 44%.

National Capital Region (NCR)

In Delhi-NCR, 4BHK+ and plots stole the show. The preference for independent and low-density living resulted in 4BHK accounting for 17% of sales, and plots accounting for 16% during the fiscal year. The region also witnessed 16% of the overall demand in 1RK/Studio category homes at the other end of the spectrum. End-users accounted for 93% of transactions, with two-thirds hailing from the service class.

Mumbai Metropolitan Region (MMR)

Due to MMR’s urban sprawl and hectic market activities in peripheral locations, the demand for mid-range and high-end homes dominates. Mid-range housing accounted for 46% of overall demand during FY21-22, while high-end homes accounted for 39%. The preference for 2BHK units is rising, accounting for 50% of the demand. The prospect of future price appreciation is also attracting investors, with approx. 13% of buyers clearly stated that they are investing for the long term.

On studying the buyer profiles, it emerges that 64% are from the service class, and 23% are from the business communities. This diversity indicates a healthy mix that will help the market withstand economic disruptions.

Bengaluru

The Tech Halli also saw increasing interest from investors during the last fiscal. Nearly 16% of home purchases were by people focused on long-term investment. A significant part of this demand appears to be fuelled by an appetite for second homes in the city’s peripheral locations. While the final verdict on the future of workplaces is yet to emerge, a hybrid model is likely to be more popular, especially among employees of the IT-ITeS sector.

Socially distanced living in the peripheral regions to ensure better pandemic safety protocols has also increased demand for plots and villas. These assets accounted for approx. 12% of transactions. This group of buyers experienced minimal or no professional impact from the pandemic and had accrued significant savings due to limited scope for general consumption.

Despite the recent marginal hike, interest rates are still attractively low, while ongoing government incentives still work well for first-time end-user buyers and second home investors. As prices begin to rise and the mortgage rate hardens, the current market dynamics may change.

About the author- Rahul Phondge, Chief Business Officer, ANAROCK Group