Union Mutual Fund Makes Its Great Debut In Factor-Based Investing

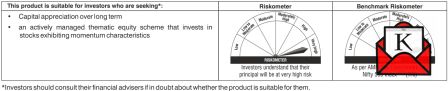

With the introduction of its new fund offer, the Union Active Momentum Fund (an open-ended equity scheme based on the momentum theme), Union Mutual Fund announced its debut into factor-based investing. The fund will invest in stocks that exhibit momentum.

An open-ended equities fund called the Union Active Momentum Fund uses a proprietary quantitative model that has undergone extensive backtesting over more than 15 years. Among the several components of the model are past price performance, return volatility, relative strength, liquidity, and so forth.

One component of a factor-based investment strategy is momentum investing. In Indian markets, where actively managed equity funds predominate, factor-based investing is a relatively new idea. It entails focusing on particular, measurable components of stock market returns, like momentum, growth, value, and low volatility.

The goal of this fund is to give investors a rules-based approach to buying stocks with momentum traits. Investments will only be made using a rule-based mechanical approach, which removes emotional biases, guarantees execution flexibility, permits disciplined entry and exit points, and makes it easier to take prompt corrective action by continuously monitoring results.

In addition to rebalancing the portfolio at least once per quarter, the actively managed fund manager will occasionally evaluate the portfolio and will have the authority to deviate from the model in the event of extraordinary circumstances. This rule-based approach aids in stock selection, allowing fund managers to employ active tactics while staying within the passive category. The fund aims to adjust to shifting market conditions by providing sectoral diversification and quarterly rebalancing.

The Union Active Momentum Fund NFO will open for subscription on November 28, 2024, and close on December 12, 2024. It will re-open within 5 business days from allotment.

Priyanka Dutta