7th Eastern India Microfinance Summit 2023 Announced

The Association of Microfinance Institutions – West Bengal (AMFI-WB) will be organizing the 7th Edition of Eastern India Microfinance Summit 2023 in Association with PwC, MFIN & Sa-Dhan. The theme of the Summit is “The Next Gen Microfinance – Role of Digital Technology in the evolving roadmap of Microfinance”. The 7th Eastern India Microfinance Summit 2023 will be held on 13th January 2023 from 9.30 am onwards at The Lalit Hotel, Kolkata.

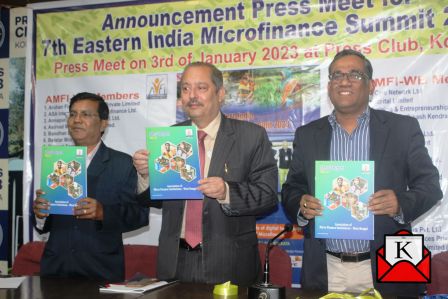

Dr. Alok Misra, CEO & Director, MFIN, Mr. Pranab Rakshit, MD, Sarala Development Microfinance Pvt. Ltd., and Mr. Ganesh Chandra Modak, MD, Grameen Shakti Microfinance Services Pvt. Ltd. briefed the media about the Summit at the press conference.

The purpose of the 7th Eastern Indian Microfinance Summit is to reevaluate the strategic roadmap required for the microfinance industry to design products that take advantage of digital tools and technologies to serve their clients in a robust and client-friendly manner. The sector is well positioned to take advantage of these regulations in order to reach out to the enormous underserved and unserved market. The recently released RBI guidelines for the microfinance industry have unleashed competitive forces in the industry and placed greater responsibility on Boards of individual companies and SRO.

The new regulatory framework’s fundamental facts sheet and maximum possible indebtedness limits will promote transparency and give clients the information they need to make credit decisions. Now that the rules are “legal form” independent, microfinance will grow sustainably and responsibly. With particular reference to West Bengal and the Northeast region, the Next Gen Microfinance Summit will promote the discussion of various trends and situations in the microfinance industry, addressing difficulties and potential solutions to overcome them.

After COVID in 2022–2023, the industry experienced a strong recovery, with loan disbursement growing by 79.7% on an annual basis during the first quarter of FY 23. The likelihood of this expansion continuing is due to the conducive policy, pent-up demand, and branch network expansion.

MFI practitioners, regulators, and funders are anticipated to attend this year’s gathering to discuss the most important issues affecting the industry. The summit intends to bring together the national and international community of stakeholders, in particular lenders and investors, to address the present and future facets of financial inclusion as well as how digital components might be included in a user-friendly way.